- Beluga Files

- Posts

- How Much Money Should You Be Putting Aside for Taxes as a Content Creator?

How Much Money Should You Be Putting Aside for Taxes as a Content Creator?

The IRS doesn't tell you this... but we can help!

The Short Answer

A safe rule of thumb is 25-35% of your gross income (this means pre-tax money).

That’s not a random number. It’s meant to cover two things:

Self-employment tax (15.3%) - this is Social Security + Medicare, which every creator pays if they make more than $400.

Federal income tax (10-37%) - this depends on your income after deductions.

State income tax (0-13%) - some states don’t have it (jealous), others absolutely do (thanks California).

Setting aside 25-35% gives you a cushion that accounts for all of the above.

The Long Answer: It Depends on How Much You Make

Here’s how it usually breaks down:

$0-$30,000 a year: Save 25-30%. Even at lower income, that self-employment tax hits.

$30,000-$75,000 a year: Still 25-30%, but you’ll creep into higher tax brackets.

$75,000-$150,000 a year: Better to save 25-35%, since you’ll be in the 22%+ federal bracket.

$150,000+ a year: Go higher, 30-40%, especially if you live in a high-tax state like CA or NY.

The idea is simple: the more you make, the higher your tax rate climbs.

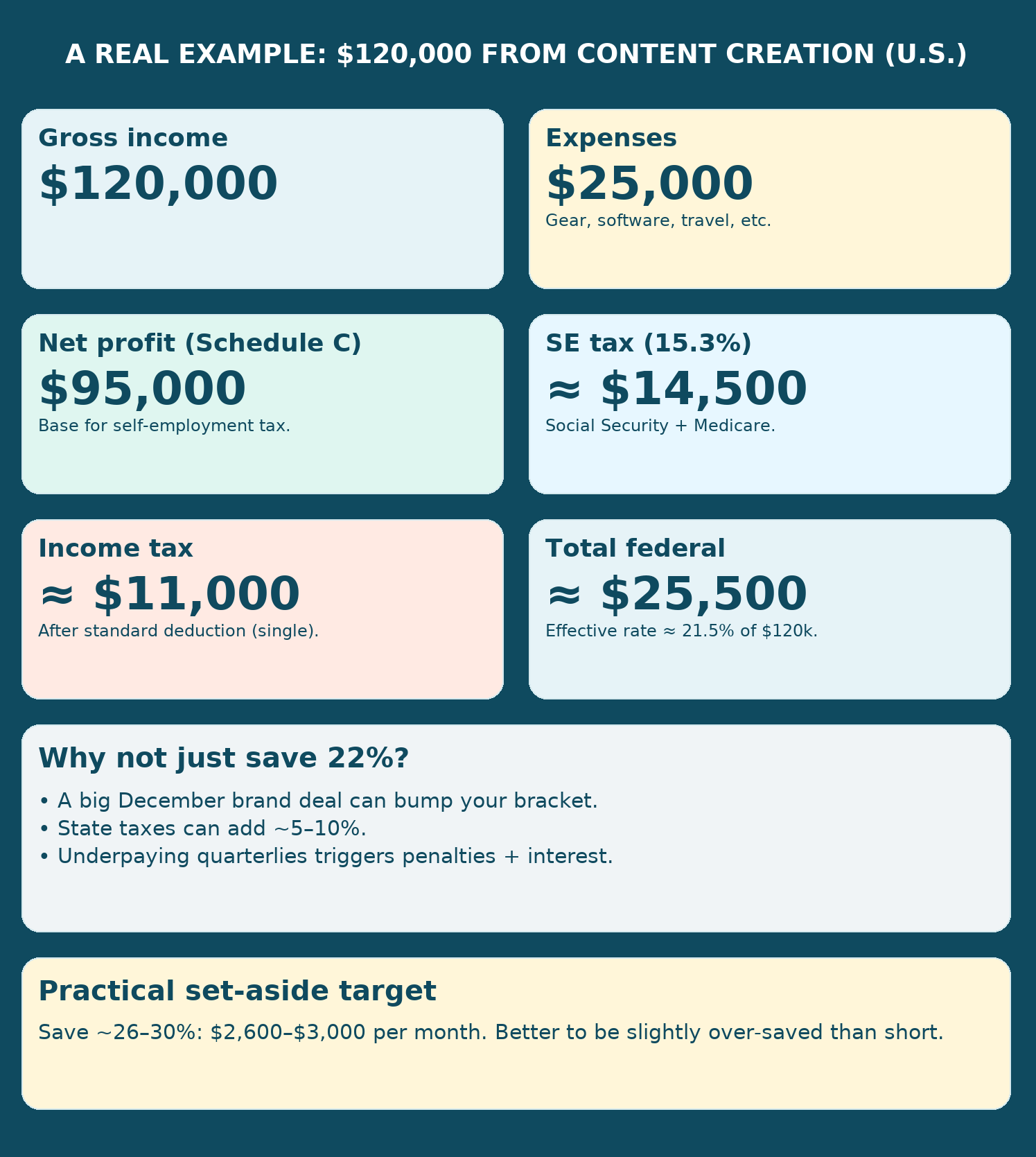

A Real Example: $120,000 earned from Content Creation

Let’s say you made $120,000 in a year between YouTube, brand deals, and affiliates. You also had about $25,000 in business expenses (gear, software, travel). That leaves $95,000 of taxable income.

Here what happens:

Self-employment tax (15.3%) → roughly $14,500.

Federal income tax (progressive brackets) → about $11,000 after standard deduction.

Total federal liability: around $25,500.

That’s an effective tax rate of about 21.5%.

But here’s why you wouldn’t just save 22% next year and call it a day:

If you land a huge brand deal in December, your rate might climb.

State taxes could tack another 5-10% depending on where you live.

Underpaying quarterlies means IRS penalties + interest.

So instead of saving 21-22%, you’d aim for 26-30% (about $2,600-$3,000 per month) to stay safe. By tax time, you’ve got more than enough set aside.

And soon, you won’t have to guess at all! Beluga Labs is developing a way to automatically withhold your taxes as you earn, so you’re setting aside money closer to your true tax rate instead of relying on a broad 25-35% rule.

Beluga Technologies, Inc.

Why Save More Than You Think You’ll Need?

Because life happens.

Income spikes. You get a big brand deal, and suddenly you’re in a higher bracket.

State taxes. Federal rules are one thing, but states can tack on another 5-13%.

Penalties. If you don’t pay enough in quarterly estimates, the IRS charges interest for being late. Even if you eventually pay in full at tax season.

Over-saving means you might end up with extra cash in April. Under-saving means you might have to drain your savings account just to pay the bill.

Making it Easy on Yourself

The best way to stay disciplined is to set it and forget it:

Open a separate savings account labeled “Taxes.”

Every time you get paid, automatically move 25-35% into that account.

Use it for your quarterly payments (April, June, September, January).

That way, you’re never staring at your checking account doing financial gymnastics on how much money is actually yours (post-tax). You will always know how much you have, and how much the IRS will be knocking on the door for.

Look, when Britain taxed our tea, we got frisky. Imagine what gon’ happen when you try to tax our whisky!

Bottom Line

The number is simple if you want to play it safe: save 25-35% of your income. The habit is harder: doing it every single time you get paid.

The creators who get in trouble aren’t the ones who don’t know the math. They’re the ones who put it off. Start early, stay consistent, and your tax bill won’t be a surprise. It’ll just be another bill you’re ready for.

This is also exactly why we’re building Beluga Labs to handle tax withholding automatically, so instead of guessing how much to save, you’ll be setting aside the right amount from the start.

Keep on Creating!

— The Beluga Labs Team